Growing challenges for banks and insurance companies

in the provider management

The procurement of consulting and general services in the financial sector is considered complex and risky, both regulatory and legally.

It encompasses a wide range of fields of application, from kitchen staff to strategy consultants, which complicates the implementation of the guidelines.

Moreover, the shortage of skilled workers makes it difficult to find externally available and affordable personnel on short notice.

Important legal risks include false self-employment and concealed employee leasing, which can cause reputational damage.

unovis

For greater efficiency, flexibility

and regulatory compliance

Your advantages at a glance

Ensure regulatory compliance.

A managed service provider ensures that your company is always compliant with current regulatory requirements, without the need for your own resources to build up extensive expertise.

Risk minimisation in third-party management.

With an experienced service provider, you minimise regulatory as well as legal risks that can cause reputational damage and financial penalties.

Efficient contract and compliance management.

A managed service provider ensures transparency in third-party management and reduces costs through a comprehensive and central contract register.

Utilise synergies in new regulations.

Procurement processes are efficiently adapted to new regulations (synergies in the process, e.g. DORA, ESG, MaRisk, etc.)

Flexibility in the face of skilled labour shortages.

Access to qualified experts without long-term commitment.

Optimised third-party procurement management.

Professional procurement for maximum efficiency and compliance.

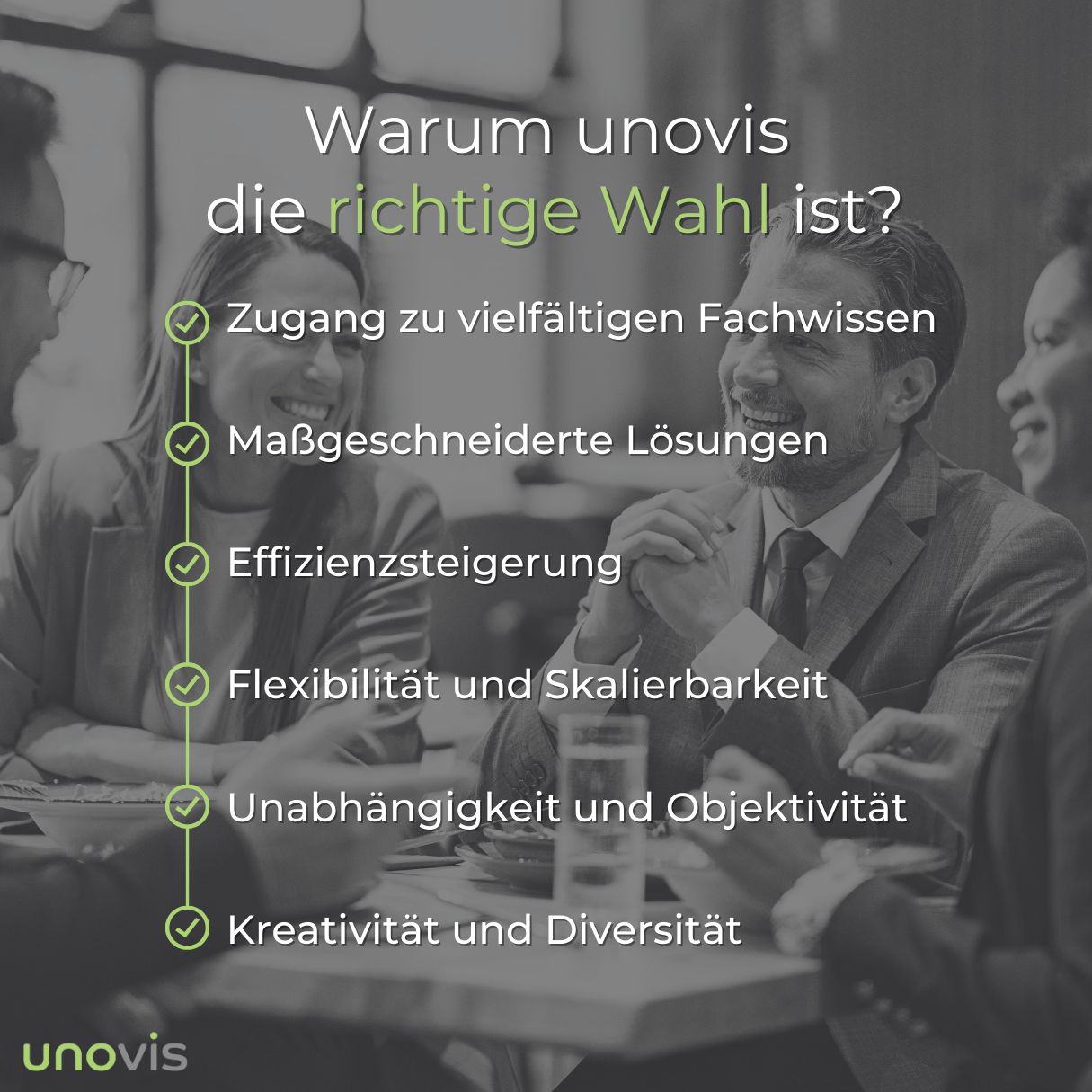

Why unovis is the right choice

Specialised in regulation:

Our experts are particularly experienced in the regulatory requirements of the financial sector and are always informed about current compliance guidelines.

Smaller, agile company:

Due to our compact company size, we offer a high level of flexibility and quick decision-making processes. Adjustments to individual customer needs can be implemented more easily and directly with us.

Competent contact persons:

We have a small, well-rehearsed team at your side that is well informed about all ongoing projects. This ensures that your concerns are dealt with quickly and efficiently at all times. Short communication channels and a comprehensive overview ensure that misunderstandings are avoided and your projects are optimally managed.

Tailored solutions:

Unlike larger providers, we can fully focus on the specific requirements and challenges of each customer and offer tailored solutions instead of standard packages.

Efficient and cost-effective solutions:

Thanks to our specialised expertise and optimised processes, we help banks save costs and conserve their resources, as we specifically develop efficient solutions that fully meet regulatory requirements.

Flexible access to experts:

We can scale the resources flexibly, which is particularly valuable in times of skills shortages.

We are ready. Are you?